About OptValue

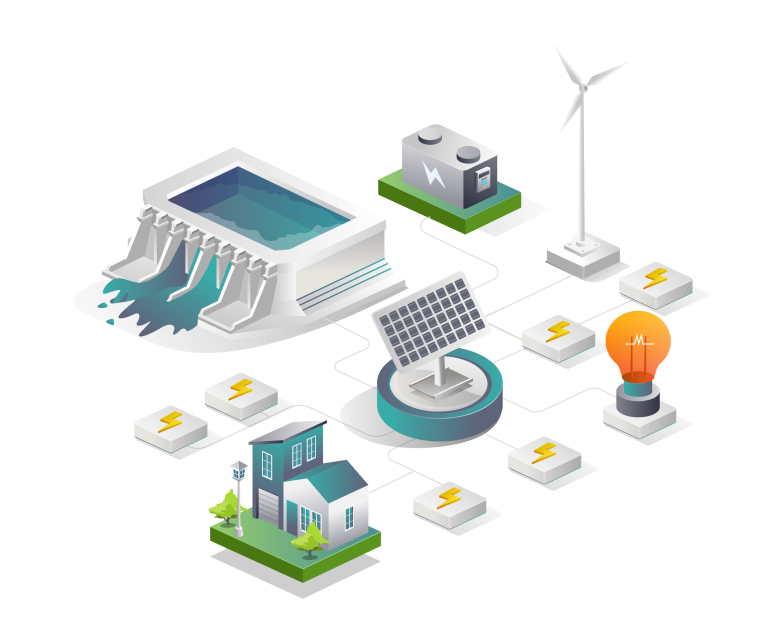

OptValue is a decision support tool developed to model and simulate the economic-financial viability of new and existing power plants. It considers various uncertainties, including renewable generation and spot prices, and assists in determining financial metrics (such as NPV and IRR) compatible with the risks associated with the construction and operation of generation plants. This allows for comparing different generation technologies, efficiently balancing risk and return.

Modeling capabilities

Technology assessment

Evaluates different technologies, new or existing, for customized investment decisions.

Comprehensive factors

Considers investment costs, operational costs, different PPA structures, taxes, and regulatory charges.

Financial metric calculation

Allows for probabilistic calculation of financial metrics such as EBITDA, NPV, and IRR.

Goal-Seeking Analysis

Calculates the contract price needed to achieve a profitability target — and vice-versa.

Impact assessment

Evaluates the impact on results of different scenarios for total CAPEX, operational delays, revenue reductions, and exchange rate variations.

Scenario-based approach

Considers uncertainties with their correlations and economic impacts in scenarios of spot prices, non-conventional renewable generation, and hydrology.

Make informed investment decisions for a sustainable energy future

OptValue includes a database with different scenarios for the main variables that represent the dynamics of the Brazilian electric power sector from physical and commercial perspectives (such as hydropower generation, spot prices, and renewable generation). These scenarios are derived from PSR’s hydrothermal dispatch model, SDDP. This way, OptValue calculates cash flows for each scenario, resulting in a probability distribution for the financial metrics of interest.

Experience OptValue now

Representation of the Brazilian system

OptValue is compatible with all market rules of the Brazilian Electric Power Sector (SEB), as it allows direct import of the CCEE algebraic rules simulation via PSR’s SCE model. It is also capable of modeling the dynamics of typical PPAs negotiated in the market (such as energy settlement and accounting, penalties for delays, financial exposure in underperformance situations, among others).

Furthermore, the model considers the main charges of the Brazilian electric power sector (such as ANEEL’s inspection fee, financial compensation for the use of water resources, etc.), taxes on revenue and profit, and offers flexibility for the inclusion of specific financing structures (for example, specific conditions from BNDES or BNB).